Summary Statement

A broad collection of tables and charts covering health and safety in the U.S. construction industry, as well as considerable economic and training data.

2007

Section 27: Employment-based Retirement Plans in Construction and Other Industries

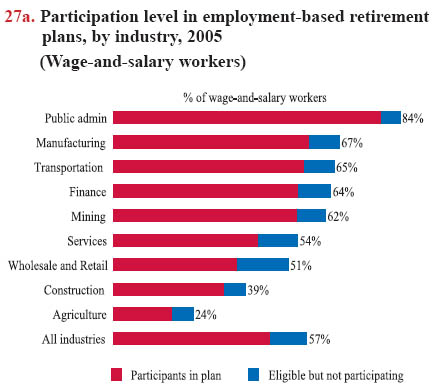

Although the need for retirement plans has become a topic of much discussion in recent years, construction workers are less likely than workers in most other industries to be eligible for – or participate in – an employment-based retirement plan. In 2005, 39% of wage-and-salary construction employees were eligible for an employment-based retirement plan, yet 33% of such workers participated in a plan (chart 27a).1 The results are consistent with previous findings from the Survey of Income and Program Participation.2

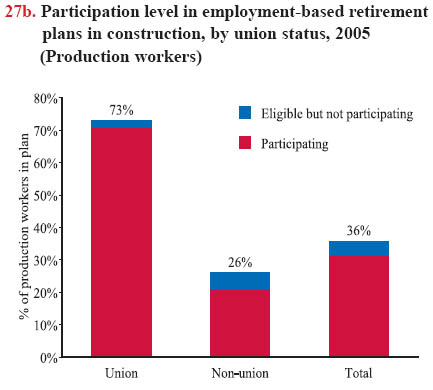

Overall, the rates of eligibility and participation in construction industry retirement plans decreased in the last decade: 42% of workers were eligible and 35% participated in 1995. Eligibility and participation rates are modestly lower among production (blue-collar) construction workers. In 2005, 36% of production workers in construction said they were eligible to participate in an employment-based retirement plan, but only 31% of those workers participated in the plan (chart 27b).These estimates are based on the 2006 Current Population Survey (CPS) Annual Social and Economic Supplement (March Supplement, formerly the Annual Demographic Supplement). The CPS surveys households, not businesses, and asks respondents if they are offered an employer- or union-provided retirement plan, if they are eligible to join, and if they participate. The CPS data do not collect information on the type of plan, so data could refer to plans with employer contributions or 401(k) plans funded solely by an employee's personal contributions. The CPS does not ask reasons for nonparticipation in employment-based plans, but there are two possible explanations: 1) an employee is not eligible because a job project or position is not covered or the employee has not been on the job long enough, or 2) an employee chooses not to participate because the plan requires employee contributions.

Another variable affecting the percentage of retirement plan eligibility and participation is company size. Only 10% of construction workers who worked for companies having fewer than 10 employees participated in employment-based retirement plans in 2005, compared with 60% in companies with 500 or more employees. The relatively large proportion of small employers in construction is a factor in the low percentages of retirement plan eligibility and participation in the industry.

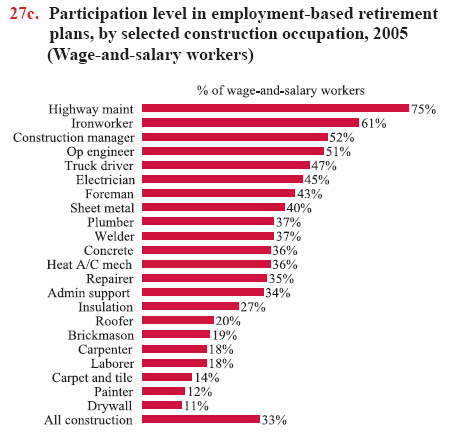

Although construction production workers have low rates of participation, union production construction workers participate in retirement plans at a much higher rate (71%) than nonunion workers (21%; chart 27b). Construction occupations having relatively high unionization rates, such as highway maintenance workers, ironworkers, and operating engineers, also have high rates of participation in retirement plans (chart 27c; see chart 11c for union membership by occupation).

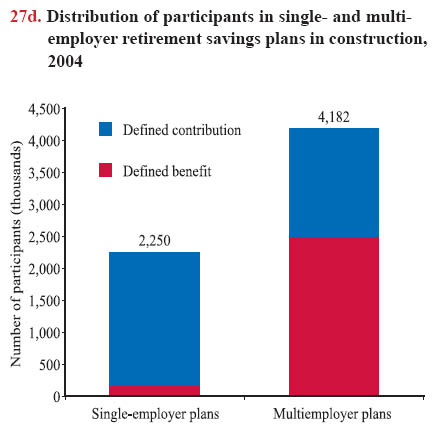

The unionized construction trades typically use a multi employer plan model to fund retirement. Contractors that have signed a collective bargaining agreement with a building trades union pay into a fund managed jointly by trustees from the union and the employers, using investment advisors to guide their decisions. These multi employer plans can offer several types of retirement plans: 1) defined benefit plans,* or traditional pension plans to which the employer contributes, 2) defined contribution plans,* such as 401(k) plans, and 3) annuity plans. Multi employer plans are common among organized employers that hire workers who change employers frequently, which occur in construction, trucking, grocery stores, and garment manufacturing.

Non-union employers operating as single employers in the construction industry can offer the same types of retirement options as multi employer plans, as well as profit-sharing and stock plans.

Approximately 65% of plan participants in construction were enrolled in multi employer plans in 2004 (chart 27d). The data were derived from the U.S. Department of Labor's Form 5500 that retirement plans having 100 or more participants must submit annually. The data also show that more than 95% of the 54,867 retirement plans in construction were defined contribution plans, and 59% of construction workers who had employment-based retirement plans participated in such plans.3

Overall, 93% of the employment-based retirement plans in the United States were defined contribution plans and 61% of participants had such plans. Over the past three decades, the private retirement system has shifted from defined benefit plans (traditional pensions) to defined contribution plans (principally the 401(k) plan), and the burden of financing retirement plans has shifted from employers to participants.3,4

Download MS PowerPoint versions of Charts

1. The numbers used in the text (except where noted otherwise) are from the U.S. Census Bureau, 2006 Current Population Survey (CPS) Annual Social and Economic Supplement. Calculations by CPWR Data Center.

2. Employee Benefit Research Institute (EBRI). EBRI Issue Brief No. 289, January 2006, www.ebri.org (Accessed November 2007).

3. Employee Benefits Security Administration, U.S. Department of Labor. Private Pension Plan Bulletin, Abstract of 2004 Form 5500, Annual Reports, March 2007, Washington, D.C.

4. John MacDonald. 2006. "Traditional" Pension Assets Lost Dominance a Decade Ago, IRAs and 401(k)s Have Long Been Dominant. Employee Benefit Research Institute (EBRI),www.ebri.org (Accessed November 2007).

* See Glossary for complete definition.

Note:

Charts 27a, 27b, and 27c - Employees were counted if they were eligible for an employment-based retirement plan during the previous calendar year.

Chart 27b - Production workers are all workers, except managerial, professional (architects, accountants), and administrative support staff – and include the self-employed

. Chart 27c - See list of occupations, chart book page 10.

Chart 27d - Participants include active, retired, and separated vested participants not yet in pay status. The number of participants includes double counting of workers who are in more than one plan. Plans are divided into defined benefits and defined contributions.

Source:

Charts 27a, 27b, and 27c - U.S. Census Bureau, 2006 Current Population Survey (CPS) Annual Social and Economic Supplement. Calculations by CPWR Data Center.

Chart 27d - Employee Benefits Security Administration, U.S. Department of Labor. Private Pension Plan Bulletin, Abstract of 2004 Form 5500, Annual Reports, March 2007, Washington, D.C.

Back to Table of Contents