Summary Statement

A broad collection of tables and charts covering health and safety in the U.S. construction industry, as well as considerable economic and training data.

2007

Section 8: Characteristics of Construction Businesses

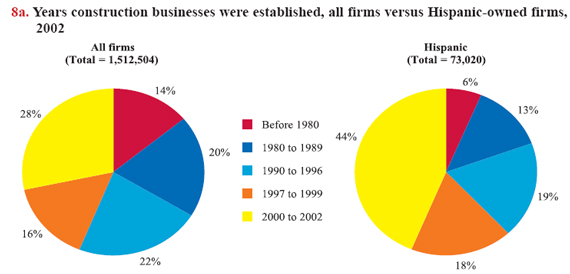

Many construction companies currently in operation are relatively new businesses, particularly those owned by Hispanics. In 2002, more than 28% of construction owners reported that their companies were established, purchased, or acquired within the past three years compared with 44% for Hispanic owners (chart 8a).1 The corresponding proportion was even higher for Hispanic companies without employees (nonemployer*). These statistics were provided by the 2002 Survey of Business Owners (SBO) which collects statistics on sources of financing for expansion, capital improvements, or start-up; types of customers and workers; and other information on business characteristics (see chart book page 7).

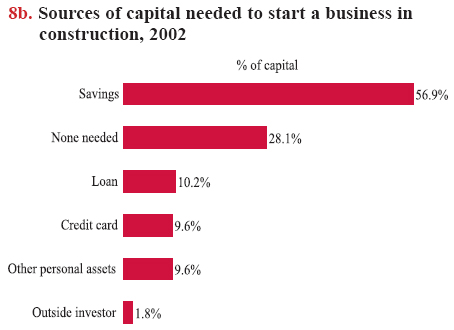

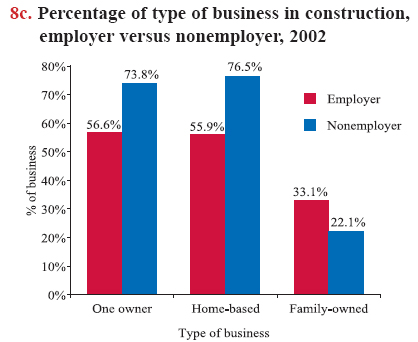

Based on the SBO, in 2002, nearly 57% of construction company owners reported that they started their business with personal savings (chart 8b). Some obtained loans from banks or government sources and others used credit cards. Only a small percentage used funding from outside investors. Notably, about 28% of companies reported that they did not need any capital to start a business in construction (chart 8b). Companies without employees on payroll (nonemployers) were less likely to need capital to start than companies with employees. Among nonemployer construction companies, 40% of Hispanic owners reported that they started their businesses without any capital sources, higher than 34% for companies with owners from other ethnic backgrounds.Approximately 71% of construction companies reported that they operated as home-based businesses, compared with 51.5% for all industries on average.1 Construction firms that were nonemployers were more likely to be home-based than firms with employees (chart 8c). Most family-owned businesses in construction had only one owner. Additionally, in construction, over 22% of nonemployer companies operated less than 12 months. More than 35% of owners of nonemployer construction firms operated their business as a supplement to their income or not as a major income source, such as a hobby, seasonal business, or a business operated occasionally.

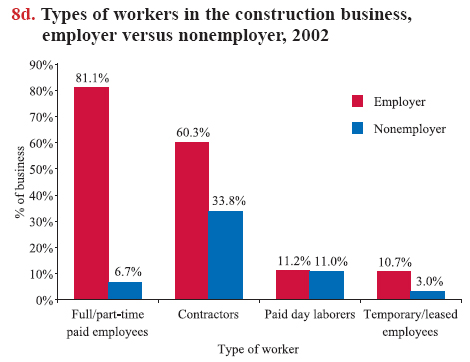

The use of contractors and subcontractors is common in construction. In 2002, more than 60% of companies with employees used contractors, subcontractors, independent contractors*, or outside consultants. Construction companies without employees also hired contractors: nearly 34% of nonemployer firms reported they used contractors in 2002 (chart 8d). Day laborers* make up another source of the workforce in construction. In 2002, more than 11% of construction companies reported that they hired day laborers. Hispanic owners in construction were more likely to use day laborers than owners in other ethnicities; the proportions were 16.3% for nonemployer firms and 14.5% for employer firms. Employers also use temporary help agencies and contracting firms to obtain workers. Almost 11% of construction companies with employees in 2002 reported that they hired temporary workers through such agencies (chart 8d). On the other hand, about 19% of employer construction firms did not have full- or part-time employees on their payroll.

Construction companies hire contractors and contingent workers* for a variety of reasons. For instance, hiring contingent workers helps employers implement "just-in-time" employment strategies. Just-in-time employment allows companies to adjust their labor supply cyclically with fluctuations in demand.2 Also, hiring contractors and contingent workers is often cheaper than retaining full-time permanent workers. Some wage-and-salary construction workers may be misclassified as independent contractors or may be included in other nonstandard employment categories (see chart book pages 20 and 21).

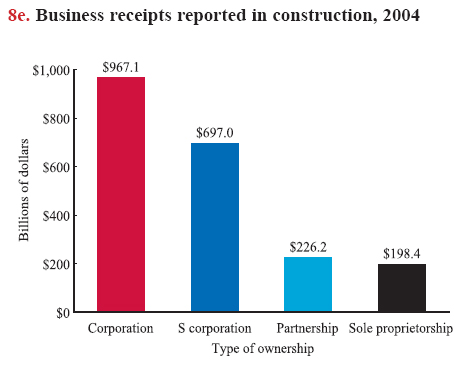

Independent contractors or self-employed workers are also known as sole proprietors; they are sole owners of their own business and they pay taxes as personal income. Although most construction companies are sole proprietorships (see chart book page 3), the majority of construction business receipts are from companies that file corporate income taxes (chart 8e). Construction firms also are held as partnerships and S corporations. S corporations* are closely held businesses with no more than 75 shareholders (family members are counted as one) according to the definition by the Internal Revenue Service. S corporations file federal income tax returns, but they are not taxed directly. Instead, they pass net income to their shareholders, who then pay income taxes. Partnerships – like S corporations – file annual information returns identifying allocations and distributions. Each partner then files his or her allocated profits along with personal income tax returns.

The categories and data used on this page are not directly comparable to other pages and previous editions of this chart book due to different data sources and changes in industrial coding systems.

Download MS PowerPoint versions of Charts

1. Companies or firms not responding to the Survey of Business Owners (SBO) questions were excluded from the percentages reported in the text.

2. Lawrence Mishel, Jared Bernstein, and Sylvia Allegretto. The State of Working America 2006/2007. An Economic Policy Institute Book. Ithaca, NY: ILR Press, an imprint of Cornell University Press, 2007, 238-247.

* See Glossary for complete definition.

Note: Chart 8a - "All firms" does not include 434,091 businesses and "Hispanic" does not include 32,044 businesses that were classified as "Item not reported" on the Survey of Business Owners in 2002.

Source: Charts 8a, 8b, 8c, and 8d - U.S. Census Bureau, 2002 Economic Census, 2002 Survey of Business Owners.

Chart 8e - Internal Revenue Service, http://www.irs.gov (Accessed November 2007).

Back to Table of Contents